For the 2022 / 2023 tax year £11,000 after tax makes £10,852 net annual income and £904 per month net salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment.

| Yearly | Monthly | Weekly | Daily | |

|---|---|---|---|---|

| Gross Income | £11,000.00 | £916.67 | £211.54 | £42.31 |

| Pension Deductions | £0.00 | £0.00 | £0.00 | £0.00 |

| Childcare Vouchers | £0.00 | £0.00 | £0.00 | £0.00 |

| Taxable Income | £0.00 | £0.00 | £0.00 | £0.00 |

| Tax | £0.00 | £0.00 | £0.00 | £0.00 |

| National Insurance | £148.40 | £12.37 | £2.85 | £0.57 |

| Student Loan | £0.00 | £0.00 | £0.00 | £0.00 |

| Take Home Net Salary | £10,851.60 | £904.30 | £208.69 | £41.74 |

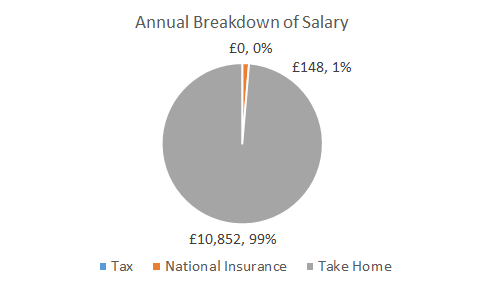

Annual take-home pay breakdown – £ 11,000.00 Net Income