By admin on 5 May 2022

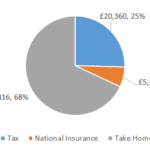

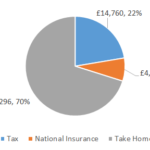

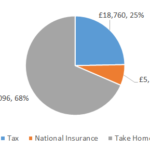

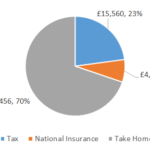

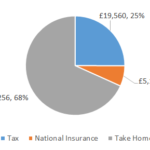

For the 2022 / 2023 tax year £80,000 after tax is £54,250 annually and it makes £4,521 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £80,000.00 […]

Posted in Uncategorized

By admin on 5 May 2022

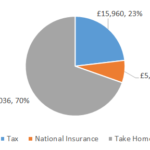

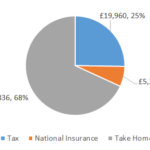

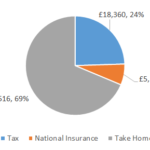

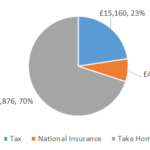

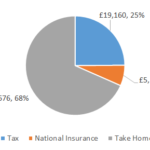

For the 2022 / 2023 tax year £69,000 after tax is £48,008 annually and it makes £4,001 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £69,000.00 […]

Posted in Uncategorized

By admin on 5 May 2022

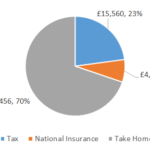

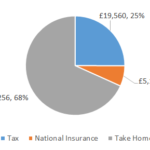

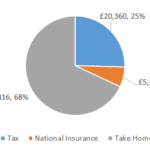

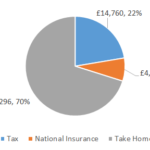

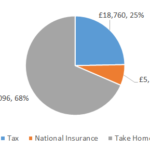

For the 2022 / 2023 tax year £68,000 after tax is £47,440 annually and it makes £3,953 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £68,000.00 […]

Posted in Uncategorized

By admin on 5 May 2022

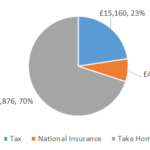

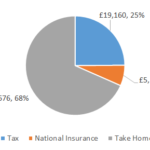

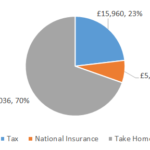

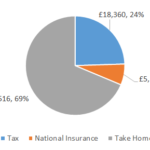

For the 2022 / 2023 tax year £67,000 after tax is £46,873 annually and it makes £3,906 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £67,000.00 […]

Posted in Uncategorized

By admin on 5 May 2022

For the 2022 / 2023 tax year £66,000 after tax is £46,305 annually and it makes £3,859 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £66,000.00 […]

Posted in Uncategorized

By admin on 4 May 2022

For the 2022 / 2023 tax year £79,000 after tax is £53,683 annually and it makes £4,474 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £79,000.00 […]

Posted in Uncategorized

By admin on 4 May 2022

For the 2022 / 2023 tax year £78,000 after tax is £53,115 annually and it makes £4,426 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £78,000.00 […]

Posted in Uncategorized

By admin on 4 May 2022

For the 2022 / 2023 tax year £77,000 after tax is £52,548 annually and it makes £4,379 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £77,000.00 […]

Posted in Uncategorized

By admin on 4 May 2022

For the 2022 / 2023 tax year £76,000 after tax is £51,980 annually and it makes £4,332 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £76,000.00 […]

Posted in Uncategorized

By admin on 4 May 2022

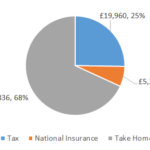

For the 2022 / 2023 tax year £75,000 after tax is £51,413 annually and it makes £4,284 net monthly salary. This net wage is calculated with the assumption that you are younger than 65, not married and with no pension deductions, no childcare vouchers, no student loan payment. Yearly Monthly Weekly Daily Gross Income £75,000.00 […]

Posted in Uncategorized